Wyoming Credit Union: Trusted Financial Solutions for every single Need

Wyoming Credit Union: Trusted Financial Solutions for every single Need

Blog Article

Elevate Your Banking Experience With Lending Institution

Credit score unions, with their emphasis on member-centric services and neighborhood participation, present a compelling option to conventional banking. By focusing on specific demands and fostering a sense of belonging within their subscription base, debt unions have carved out a specific niche that resonates with those looking for an extra personalized method to managing their financial resources.

Advantages of Lending Institution

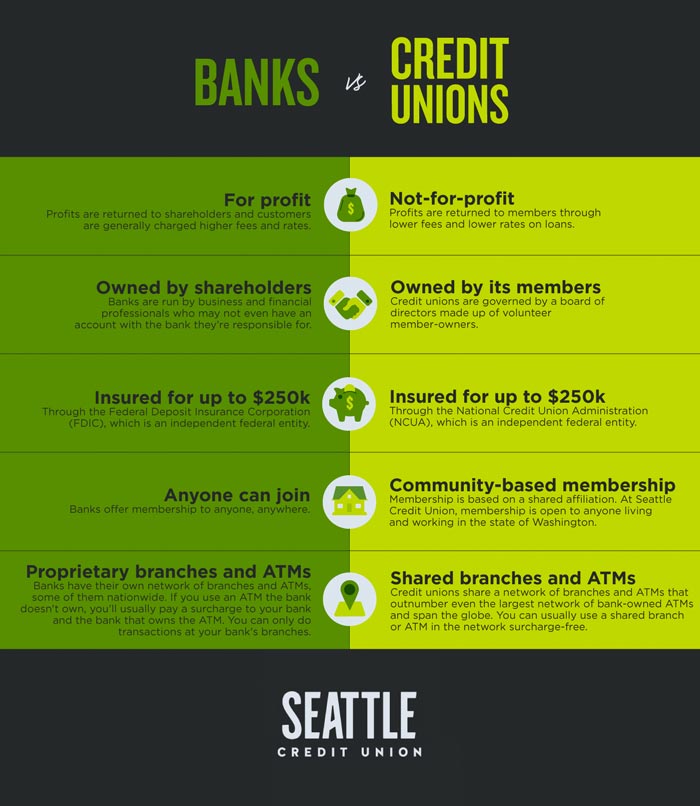

Unlike financial institutions, credit score unions are not-for-profit organizations possessed by their members, which often leads to reduce fees and better passion rates on financial savings accounts, finances, and credit report cards. Additionally, debt unions are understood for their customized customer solution, with personnel members taking the time to recognize the special monetary goals and obstacles of each member.

One more advantage of lending institution is their autonomous structure, where each member has an equivalent ballot in choosing the board of directors. This guarantees that choices are made with the ideal interests of the participants in mind, instead than concentrating solely on taking full advantage of earnings. Credit rating unions typically use economic education and learning and therapy to aid participants enhance their monetary proficiency and make notified decisions regarding their money. In general, the member-focused method of lending institution establishes them apart as organizations that prioritize the wellness of their community.

Membership Requirements

Some credit score unions may serve people who live or work in a certain geographical location, while others may be associated with certain firms, unions, or associations. Additionally, family members of present credit score union members are frequently eligible to join as well.

To come to be a participant of a cooperative credit union, people are generally required to open an account and maintain a minimal deposit as specified by the organization. In some situations, there may be one-time membership charges or continuous membership fees. When the membership criteria are met, people can appreciate the advantages of coming from a lending institution, including accessibility to individualized economic solutions, competitive interest prices, and an emphasis on member fulfillment.

Personalized Financial Solutions

Customized financial services customized to specific requirements and preferences are a hallmark of cooperative credit union' dedication to member satisfaction. Unlike traditional banks that often supply one-size-fits-all options, lending institution take a more personalized strategy to handling their members' finances. By recognizing the special goals and circumstances of each participant, cooperative credit union can give tailored referrals on financial savings, financial investments, financings, and various other monetary items.

Lending institution prioritize constructing strong partnerships with their members, which permits them to offer individualized services that exceed simply the numbers. Whether someone is conserving for a particular goal, preparing for retired life, or wanting to boost their credit rating, lending institution can develop customized monetary strategies to aid members accomplish their goals.

In addition, credit history unions typically provide reduced charges and affordable rate of interest on cost savings and financings accounts, further enhancing the customized monetary solutions they offer. Credit Unions Cheyenne WY. By focusing on individual needs and providing tailored services, cooperative credit union establish themselves apart as relied on economic companions devoted to assisting participants prosper economically

Neighborhood Involvement and Support

Community engagement is a cornerstone of cooperative credit union' objective, showing their commitment to supporting regional campaigns and promoting significant links. Lending institution actively participate in area occasions, enroller neighborhood charities, and organize financial proficiency programs to educate participants and non-members alike. By buying the communities they offer, lending institution not only reinforce their connections however additionally add to the overall health of culture.

Supporting tiny services is another means cooperative credit union show their commitment to Hybrid Line of Credit neighborhood neighborhoods. Via using bank loan and economic guidance, lending institution aid entrepreneurs prosper and stimulate economic growth in the location. This support surpasses just monetary aid; credit report unions often give mentorship and networking possibilities to aid tiny services are successful.

In addition, cooperative credit union often participate in volunteer work, encouraging their employees and participants to return through various area solution activities. Whether it's taking part in regional clean-up events or arranging food drives, cooperative credit union play an energetic function in enhancing the lifestyle for those in need. By prioritizing area participation and support, cooperative credit union truly personify the spirit of participation and common support.

Online Banking and Mobile Applications

Mobile apps supplied by lending institution additionally enhance the financial experience by offering additional versatility and availability. Members can execute numerous financial jobs on the move, such as depositing checks by taking a photo, receiving account alerts, and also getting in touch with consumer support straight with the application. The safety of these mobile apps is a leading priority, with functions like biometric verification and file encryption protocols to guard sensitive details. Generally, lending institution' electronic banking and mobile applications encourage members to manage their finances effectively and firmly in today's fast-paced digital globe.

Conclusion

In conclusion, credit history unions supply a distinct banking experience that prioritizes neighborhood involvement, tailored solution, and member fulfillment. With lower costs, competitive passion rates, and customized financial solutions, credit rating unions provide to individual demands and promote economic wellness.

Unlike banks, credit unions are not-for-profit companies had by their members, which usually leads to reduce fees and far better interest prices on cost savings accounts, fundings, and debt cards. Furthermore, credit score unions are known for their individualized customer service, with personnel participants taking the time to understand the unique financial objectives and difficulties of each participant.

Report this page